The FLSA sets a minimum wage of 213 an hour for tipped employees and permits a tip credit of 512 an hour. The Wage Payment and Collection Law is not just a collection of mandates from on high.

Changes For Pennsylvania Minimum Wage Go Into Effect In August

Operation of private employment agencies.

. Miscellaneous hazards and conditions ofemployment. The WPCL was enacted to provide a vehicle for employees to enforce payment of their wages and compensation held by their employers. Section 2603 - Regular payday.

Employers also must notify employees at the time of hire of any fringe benefits they may receive. In Pennsylvania federal and state laws govern pay day laws including wage and hour requirements. 329 of July 14 1961.

In Pennsylvania employers are not required to provide employees with vacation benefits either paid or unpaid. Any Employee as defined under the Pennsylvania Wage Payment and Collection law may bring a civil action in court to recover the back-due wages. Pennsylvania law sets a higher minimum wage of 283 an hour for tipped employees and.

Pennsylvania law does not specifically address whether an employer may deduct or withhold wages from an employees pay check to pay for. It also sets forth compliance-related duties for the Department of Labor Industry and for employers. PA Minimum Wage Law The Pennsylvania Minimum Wage Act as amended in 2006 establishes a fixed Minimum Wage and Overtime Rate for employees in Pennsylvania.

Wage payment and collection laws. This is an employment law that employees can use to secure the payment of compensation and wages that they are owed from their employers. In an effort to expedite your complaint the Bureau of Labor Law Compliance encourages you to take advantage of the online or electronic submission of the complaint form.

Section 2608 - Enforcement. The major federal law governing wages and hours is called the Fair Labor Standards Act FLSA. The Pennsylvania Wage Payment and Collection Law WPCL does not create a right to wages or benefits but provides a statutory remedy where the employer breaches a contractual righ t to wages that have been earned.

When an employee is hired or separates from employment one statute both the employee and employer must consider is the Pennsylvania Wage Payment and Collection Law WPCL 43 PS. Amended through September 1 1969 unless otherwise noted. Contracts for commonwealth printing 9201 subchapter a.

It regulates how much workers must be paid. However to the extent an employer chooses to provide such benefits it must comply with the terms of its established policy or employment contract. Pay days must occur at least every fifteen days or longer if customary in the particular industry.

329 Wage Payment and Collection Law 43 P. Source The provisions of this Subchapter A adopted August 26 1961. The provisions of this Subchapter A issued under section 3 of the act of July 14 1961 P.

The answer can be found in the Pennsylvania Wage Payment and Collection Law. 2601 WPCL is a Pennsylvania employment law that provides a means by which employees are able to recover unpaid wages from their employers. Pennsylvania Wage Payment and Collection Law The Wage Payment and Collection Law lays out how employers should pay employees and provides a mechanism by which employees can recover unpaid wages they are owed.

Pennsylvania Title 43 PS. In short an employer must follow its own rules for these kinds of benefits or payments. Section 2606 - Unconditional payment of wages conceded to be due.

2603 unless otherwise noted. WAGEPAYMENTANDCOLLECTIONLAW ActofJul141961PL637No329 Cl43 ANACT Relatingtothepaymentofwagesorcompensationforlaboror servicesprovidingforregularpaydays. The employer can also inform the Secretary of Labor by filing a complaint regarding your wage claim and the Secretary of Labor will immediately notify the employerformer employer of the claim.

In addition the Minimum Wage Act provides penalties for noncompliance. Authority The provisions of this Subchapter A issued under section 3 of the act of July 14 1961 PL. Wage payment and collection laws.

The WPCL is a state law that acts as a vehicle to recover unpaid wages and also provides. Hiring and firing employees requires consideration of multiple legal issues. Section 2607 - Provisions of law may not be waived by agreement.

2603 unless otherwise noted. In Pennsylvania workers have protections and a method to enforce the payment of their paychecks under the Pennsylvania Wage Payment and Collection Law. Pennsylvania Title 43 PS.

Cash shortages breakage damage or loss of the employers property purchase of required uniforms or clothing required tools other items necessary for employment. Read the code on FindLaw. Complaint Form for Unpaid Wages Workers Owed Wages WOW search tool.

Section 2604a - Computation of wages by railroads. Overtime wages may be considered as wages earned and payable in the next succeeding pay period. Section 2604 - Notification.

According to the law all employers are required to pay wages on regularly scheduled paydays that are determined in advance. Wage Payment and Collection Laws Sec. All wages other than fringe benefits and wage supplements earned in any pay period shall be due and payable within the number of days after the expiration of said pay.

For instance an employee or labor organization can bring a claim against the employer under the law or can refer its claim to the Pennsylvania Secretary of Labor. It contains teeth for the enforcement of its provisions. This act shall be known and may be cited as the Wage Payment and Collection Law.

Payment of Wages to Employees All men women and minors employed within Pennsylvania by an employer are protected by the Wage Payment and Collection Law Act No. The Wage Payment and Collection Law 43 Pa C. GENERAL PROVISIONS 91.

Section 2605 - Employes who are separated from payroll before paydays. Common carriers by railroad. The major state laws governing pay day requirements is known as Pennsylvania Wage Payment and Collection law.

Welcome to FindLaws Cases Codes a free source of state and federal court opinions state laws and the United States Code. Read the code on FindLaw. The WPCL mandates that employers have regular set pay days and that they notify employees in advance as to when their pay days will be.

Wage Complaint Form Description This form is used to file complaints under the Pennsylvania Wage Payment and Collection Law Act of 1961 PL.

Nobel Prize On Instagram To Investigate How Increased Minimum Wages Affect Employment David Card Awarded The 2021 Prize In Economic Sciences And Alan Krueger

Guide To Local Wage Tax Withholding For Pennsylvania Employers

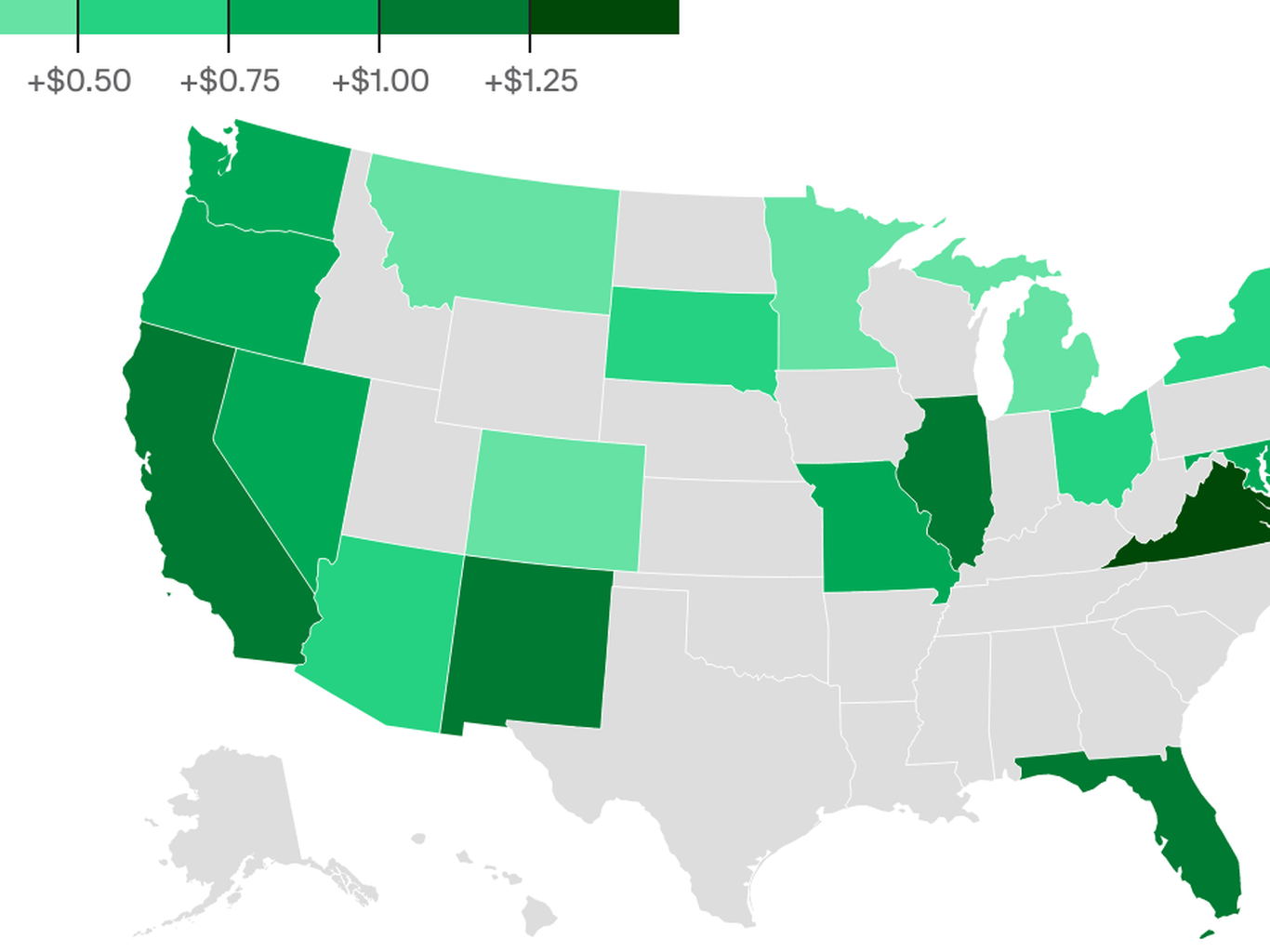

Minimum Wage Stalls In Pennsylvania As Nearby States See Increases Axios Philadelphia

Pennsylvania Wage Payment And Collection Law Lamb Mcerlane Pc

Pennsylvania 15 Minimum Wage Push Renewed Govdocs

2022 Pennsylvania Payroll Tax Rates Abacus Payroll

How To Shrink America S Gender Pay Gap

State Minimum Wage Rate For Pennsylvania Sttminwgpa Fred St Louis Fed

0 comments

Post a Comment